How to open a business?

Type of Businesses

In Vanuatu, Businesses can operate as the following legal entities: Sole Trader, Partnership, or Company (local or overseas company registered in Vanuatu).

Sole trader: The simplest type of business is a sole trader in which there is only one owner of the business. The owner is solely responsible for any debts incurred by the business.

Partnership: A partnership is where two or more people contribute their own resources. This can be in the form of cash, property, or even their time. Often an agreement is drawn up detailing how they share the profits between them. A partnership is usually used by professionals, like accountants and lawyers.

Company: A company is a separate legal entity from the owners of the company. This means they are protected from liability incurred by the company. You may want to incorporate a company and restrict the liability that you will personally face in the event that your company goes bankrupt or a client tries to sue the company for damages.

Formal vs informal businesses

The formal sector consists of the businesses and economic activities that are monitored, protected and licensed by the government, whereas the informal sector is comprised of the workers and businesses that are not under government regulation. It is considered informal since these businesses are not registered at a municipality or provincial level, are generally cash-based, do not pay VAT and usually do not have formal arrangements with employees (e.g.: no contracts and do not pay VNPF).

According to the NSDP Baseline Survey 2019, only 33 per cent of the workforce in Vanuatu is engaged in formal employment and the formal economy only offers some hundreds of jobs each year.

Business Registration

How do I register my business?

In Vanuatu, every business name must be registered with the Vanuatu Financial Services Commission (VFSC). This can be done one of two ways:

- Online through the VFSC website (https://www.vfsc.vu/).

- In person at the VFSC office located at Companies House, Rue Bougainville, Port Vila, Vanuatu.

What is the penalty for operating without a business registration?

Penalties are determined by the Department of Customs and Inland Revenue and are decided on a case-by-case situation.

For more details visit: https://www.vfsc.vu. Or contact:

PORT VILA MAIN OFFICE:

Vanuatu Financial Services Commission

Companies House

PMB 9023

Rue Bougainville

Port Vila, Vanuatu

Tel: +678 22247

For Registration issues, send email to: registrar@vfsc.vu

For any other issues & information, email: info@vfsc.vu

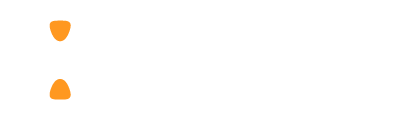

Online Business Registration

Step 1. Decide on a business category and Business Name

Step 2. Prepare electronic copies of documents. To save time, you should have the following details ready:

- Personal details (First and Last name, date of birth) & electronic copy of your national ID

- Contact details (email address, physical address and phone number)

- Proposed Business Name

- Business activity (e.g.: accommodation, agriculture, transportation etc)

- Business address details (email address, physical address and phone number)

- Business owner details

Note: Any financial/lending business activity also requires 3 months of banks statements.

Step 3.

Visit https://www.vfsc.vu/ and create an online/ E-account by clicking on the ‘Register’ tab on the right side of the homepage or simply click on the following link: https://www.vfsc.vu/vanuatu-security/viewInstance/view.html?id=a5c1e83ff0a6678bd260d8a11ee4523211083e920dc5f9062d4df6ee932ba343&_timestamp=7616011913332399&targetAppCode=vanuatu-security

You must enter all required information and follow the prompts on the online form. Once all the required information has been entered, click on the ‘submit’ tab.

Step 4.

Pay your business registration fee in person at the VFSC office reception desk. A credit will be applied to your E-account. You must provide your email address or E-account username so the cashier can apply the credit to your online account.

Note: online payments via visa debit/credit card are currently not available.

Step 5.

Once you have paid your registration fee, log back into your VFSC E-account and resubmit your online application for processing. An automated email will be sent to your email address confirming receipt of your application.

Your electronic copy of your VFSC business registration certificate will be sent to your email address within 5 working days.

Business registration in person

Step 1. Visit the VFSC office and collect a business registration application form from the reception desk. You must fill out all details in the form.

To save time, you should have the following details ready:

- Personal details (First and Last name, date of birth) & copy of your national ID

- Contact details (email address, physical address and phone number)

- Proposed Business Name

- Business activity (e.g.: accommodation, agriculture, transportation etc.)

- Business address details (email address, physical address and phone number)

- Business owner details

Step 2. Submit paper form and pay your business registration fee at the VFSC office reception desk.

Step 3. Collect your business registration certificate after 5 working days at the VFSC reception desk.

How much does it cost to register?

The current business name registration fees are as follows:

- If you submitted a paper application in person: 12,000 vatu

- If you submitted an online application: 10,000 vatu.

Note: For online applications, once the payment has been made, a credit will be applied to your online VFSC account. After payment, you must log back in and resubmit the form for the application to be processed.

The VFSC currently accept the following payment methods: Cash, cheque and BSP & Bred Eftpos.

Tax Registration

As part of the recent Vanuatu Tax Administration Act (TAA 37), the Customs and Inland Revenue Department (DCIR) introduced “Tax Identification Numbers” (TIN).

It is a unique identification number that will help the DCIR identify taxpayers. The TIN is a must have for automatic exchange of information under the Common Reporting Standard (CRS) system. Everyone in the business community will need to have a TIN (e.g.: those who pay VAT, Rent Tax, and those who hold a business license).

Tax Identification Number (TIN)

- If you are currently business license holder or are subject to a tax law (rent tax, VAT) you do not need to apply for a TIN number. Your Customs Tax (CT) number automatically becomes your TIN number.

- If you are not a current business license holder and not subject to tax law (rent tax, VAT) you will need to follow the below steps to apply for a TIN number:

Step 1:

Visit the Customs and Inland Revenue Department (DCIR) and collect a paper application form from the Taxpayer Services Section. You can also print out the online form found here: https://customsinlandrevenue.gov.vu/images/Forms/TAA/Application_for_TIN_Form.pdf

Step 2:

Complete the TIN application form and submit at the DCIR taxpayer services section along with a certified copy of your business registration certificate and a certified copy of your ID.

Additional details about the Tax Identification Number (TIN)

- How much does it cost to obtain a TIN?

There is no cost to obtain a TIN

- Where to go to for Tax registration?

Customs and Inland Revenue Department, located at Rue Carnot PMB 9021, Port Vila

- Which section/unit of the tax office should you go to?

Taxpayer Services Section

- What documents do you need to lodge for a TIN

- Completed TIN application form

- Certified copy of VFSC certificate (See Section 3)

- Certified copy of ID (national ID or passport)

- What is the penalty for operation without a TIN?

A person who is required to apply for a TIN but fails to do so is liable for a penalty. The penalty is VT10,000 for each month that they have not applied - from the date they were required to do so.

For more information visit: https://customsinlandrevenue.gov.vu/index.php/taxes-and-licensing/changes-from-1-jan-2020/tax-identification-numbers

Business License

The Rates and Taxes Office under the Department of Customs and Inland Revenue is responsible for issuing business licenses in the municipalities of Port Vila and Luganville. Provincial Councils are responsible for issuing business licenses to businesses operating in all rural areas outside of these two municipalities.

The Business License Act (Cap 249) regulates the issuing of businesses licenses throughout the country. Section 2 specifies that no person shall carry on a business without a license.

An exemption from paying business license fees is available to the following professions with turnover below VT 10 million per year: artists and sculptors, farmers, dairymen, market gardeners, stock breeders, vegetable and fruit hawkers, and fishermen.

Income generated by export activities is also exempted in the calculation of the business license fee.

Note: Businesses that import goods for the purpose of re-export (without any alteration to the good’s content apart from packaging) are subject to business license like the rest of the categories. Such businesses are categorized under category D1 – refer to business license (amendment) No. 34 of 2010.

A separate business license is required for each physical premises operated by a business. Once obtained, the license must be displayed in a prominent place on the premises. Licenses are issued for a maximum period of 12 months and must be renewed annually at the start of each calendar year.

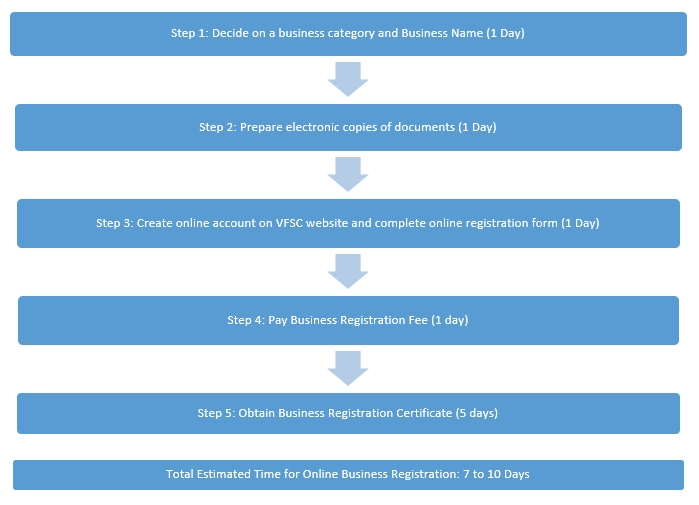

Steps to Obtaining a Business License

Step 1. Before starting the process of applying for a business license, check you have the following documents/information ready:

- Business Registration Certificate from VFSC (Insert link of respective Section here)

- TIN Number or Completed TIN Application Form if you do not have one (Insert link of respective Section here)

Step 2. Collect and complete business license application form available from the invoicing counter at Rates and Taxes office or print the online form available here: https://customsinlandrevenue.gov.vu/images/Forms/rates_taxes_forms/2015_New_BL_Application_Form.pdf

Step 3. Lodge the business license application form along with your business registration certificate and TIN number or completed TIN Application Form at the invoicing counter at Rates and Taxes. You will be provided with an invoice to pay in order to proceed.

Step 4. Take the invoice to the Cashier counter in Rates and Taxes and pay the fee. Cash, Cheque and BSP/Bred Eftpos are accepted methods of payment. You will be issued a receipt.

Step 5. Lodge receipt, business license application form, business registration certificate and TIN number at Invoicing Counter at Rates and Taxes Office.

Step 6. Collect business license at Taxpayer Services Counter after 5 business days.

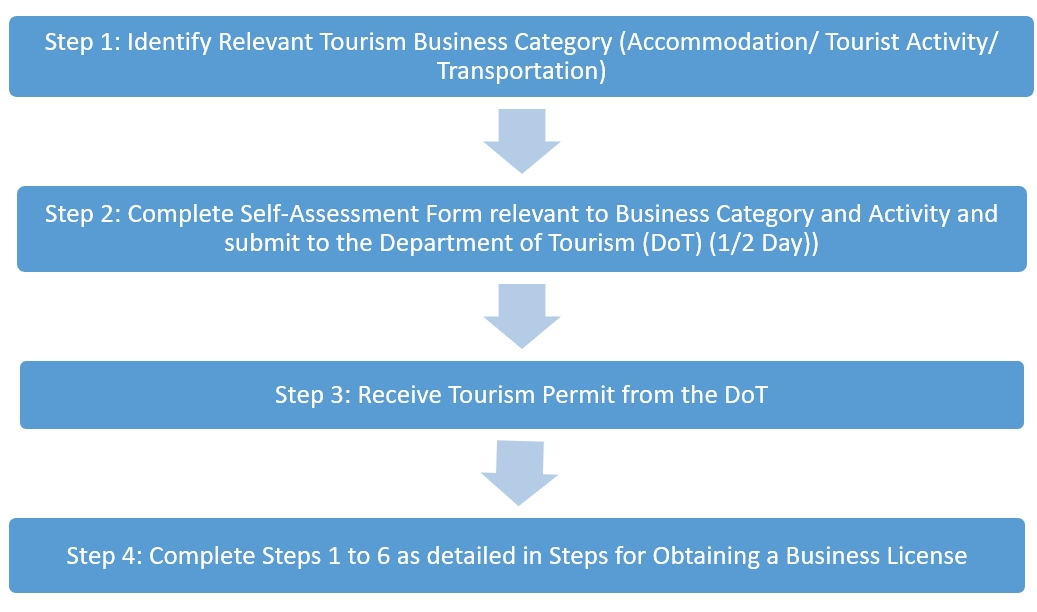

Business License for Tourism Businesses

Membership of an accredited association such as VHRA is also a requirement for any business license in a tourism category.

If you have a Tourism Business (transport, tour or accommodation), there are additional steps to obtaining a business license. You must first be accredited by the Tourism Department and obtain a conditional Tourism Business Permit. You must also become a member of a certified Tourism Association, such as the Vanuatu Hotel and Resorts Association or the Vanuatu Tour Operators Association.

The Department of Tourism accreditation steps are outlined below:

Step 1: Identify Relevant Tourism Business Category (Accommodation/ Tourist Activity/ Transportation)

Step 2: Complete Self-Assessment Form relevant to Business Category and Activity and submit to the Department of Tourism (DoT). Forms are available from the DoT or can be printed from this link here: https://tourism.gov.vu/index.php/en/accreditation-resources

Step 3: Receive Tourism Permit from the DoT

Step 4: Complete Steps 1 to 6 as detailed in section above.

More information on tourism permits and accreditation can be found here: https://tourism.gov.vu/index.php/en/accreditation-main

Categories and activities for Businesses

The different types of business categories and activities are detailed below:

|

Category |

Description |

Business License Activities |

|

A |

Mining, Quarrying and Logging |

Mining for minerals Quarrying and other mining Logging |

|

|

Manufacturing Industries and Trade |

Abattoir and meat packing Canneries Oil mill Bakeries and confectioneries Manufacture of food products not elsewhere classified Manufacture of prepaid animal feeds Distilleries Breweries Manufacture of carbonated non-alcoholic beverages Manufacture of cordials and non- carbonated or non-alcoholic beverages Manufacture of tobacco Sawmills, planning and other wood mills Artifacts and decorative small furnishing Manufacture of paper, paper products, printer and publisher Manufacture of chemicals, chemical products Manufacture of rubber and plastic products Manufacture of soap and cleaning preparations Shipbuilders and repairers Manufacturers of wearing apparels (dressmakers and tailors working alone or employing not more than two apprentices are licensed under category G) Jewelers Home manufacturer and purveyors of pies, meat balls, nems and similar prepared foods Home manufacturer of beverages of all kinds excluding Air conditioning and refrigeration Manufacture of cement, lime and plaster Manufacture of structural and fabricated metal products Other manufacturers not elsewhere classified |

|

C |

Construction Industries and trade |

General and specific trade contractors Artisans working alone (or with up to two apprentices – bricklayers, painters, decorators, jobbing builders, masons, plumbers, welders, fitters, turners) Computer network installation Motor vehicle repair shops Salvaging & Demolishing Services Other construction industries and trade not elsewhere classified |

|

D1 |

Import and re-export |

Businesses that import and re-export goods without transforming them |

|

D2 |

Retailers and wholesalers |

Retailers Wholesalers Butchers Pharmacists and druggists Other wholesale and retail merchandising not elsewhere classified |

|

D2(a) |

Specialty Shops |

Duty Free Shop Boutique Shop |

|

D3 |

Hotels, Motels, Restaurants, Cafes, Bars & Other Accommodation Services |

|

|

D3(a) |

Hotels & Resorts Accommodations |

Hotel Resort |

|

D3(b) |

Motels & Self Contained |

Motel Self Contained Units |

|

D3(c ) |

Unique |

Modern Bungalows Tent Lodge Clamping Theme |

|

D3(d) |

Holiday Homes |

House Vacation Rental Short Term Stay Holiday Cottage Holiday Lodge |

|

D3(e) |

Guest Houses |

Hostel Backpackers Bed & Breakfast |

|

D3(f) |

Island Bungalows |

Island Bungalows |

|

D3(g) |

Home Stays |

Home Stay |

|

D3(h) |

Camp Sites |

Camp Site |

|

D3(j) |

Restaurants |

Restaurant |

|

D3(k) |

Cafes |

Cafe |

|

D3(l) |

Bars |

Bar |

|

D4 |

Take-Away Food Outlets and Catering Services. |

|

|

D4(a) |

Take-A ways |

Take-Away |

|

(D4(b) |

Catering Services |

Catering Services |

|

D5 Reserve Investments |

Open Air Vendors, Mobile shops and door-to-door sales |

Open Air Vendors Mobile Shops Door-to-door sales |

|

E |

Transportation, Storage Facilities and Tourism Services |

|

|

E1(a) |

Air Transport |

Air transport operators and carriers Airport Agents Helicopter Charters Aircraft Charters/Leased Other Support services to air transport |

|

E1(b) |

Sea Transport |

Ship and boat owners and operators Shipping Agent |

|

|

|

Seaport agents Fishing Boat charters Other Support Services to Sea Transport |

|

E1(c) |

Land Transport |

Bus Transport Operators Taxi Transport Operators Public Transport Operators Other Road Transport Operator Other Support Services to Land Transport |

|

E2 |

Storage Facilities (Transport Support Services) |

Storage and warehousing services Stevedoring and wharf facilities and services Customs agents Courier Services Freight Forwarding Services Container Freight Services Other transport support services |

|

E3 |

Tourism Transportation, Products and Services |

|

|

E3(1) |

Air Tourism Transports |

|

|

E3(1a) |

Air Transports |

Plane Operator Helicopter Operator |

|

E3(2) |

Sea Tourism Transports |

|

|

E3(2a) |

Water Transports |

Watercraft Marine & Motorized Water Operator Other Water Transport |

|

E3(2b) |

Yacht or Boat Charters |

Yacht Charter Boat Charter |

|

E3(3) |

Land Tourism Transports |

|

|

E3(3a) |

Tourism Land Transportation |

Service Bus Taxi |

|

E3(3b) |

Tours & Transfers |

Tour Operator Transfer Operator |

|

E3(4) |

Tourism Tours & Activities |

|

|

E3(4a) |

Educational & Interest Tours |

Education & Interest Tour |

|

E3(4b) |

Travel Agency |

Outbound Operator |

|

E3(4c) |

Inbound Operator |

Tour Agent |

|

E3(4d) |

Tour Guide |

Tour Guide |

|

E3(4e) |

Handy Craft & Arts Shop |

Handy Craft Shop Arts Shop |

|

E3(5) |

Tour Products (Sea/Water Based Activities) |

|

|

E3(5a) |

Marine & Water Adventure |

Parasailing Underwater Walks Fly Boards Glass Bottom Boat Snorkeling Kayaking |

|

E3(5b) |

Scuba Diving |

Scuba Diving Operator |

|

E3(5c) |

Traditional Canoe |

Traditional Canoe Operator |

|

E3(5d) |

Game Fishing Tour |

Game Fishing Operator |

|

E3(6) |

Tour Products (Land Based Activities) |

|

|

E3(6a) |

Land Adventures |

Zip Line Zorbing Blok Art Quad Bike Bicycle Tours Abseiling Horse Riding Water fall Suspended Bridge Tours Cave Tours Volcano Tours Hiking (Bush Trekking) |

|

E3(6b) |

Traditional & Cultural Activity |

Custom Village Land Diving Fire Walking Custom Dance Cultural Feast Traditional Farm Tour |

|

E3(6c) |

National Park |

National Park Operator |

|

E3(6d) |

Conservation Area |

Conservation Area Operator |

|

E3(6e) |

Other Services |

Museum Operator Other Tourism Support Services |

|

E4 |

Rental & Hire Services |

Vehicle Rental and Hire Services Plant and Machinery Rental and Hire Services Equipment Rental and Hire Services Boat Rental and Hire Services Other Rental and Hire Services |

|

E4(a) |

Rentals |

Cars Hire Services Bicycles Hire Services Scooters Hire Services Buses Hire Services Trucks Hire Services Quads Hire Services Tuktuk Hire Services |

|

F1 |

Commercial Banks |

Commercial bank |

|

F2 |

Other Financial Institutions |

Trust Companies Financial Institutions Finance and Investment Companies |

|

F3 |

Insurance Companies |

|

|

F3(a) |

Domiciled Insurance |

Domiciled Vanuatu Licensed Insurance Company |

|

F3(b) |

Non Domiciled Insurance |

Non domiciled Vanuatu licensed insurance company |

|

F3(c) |

Insurance Agents |

Insurance agents |

|

F3(d) |

Insurance Brokers |

Insurance brokers |

|

F4 |

Other professional and business services |

Real estate agent Property managers Land and property developers Legal practitioners Accounting practitioners Engineering practitioners and services Architectural practitioners and services Surveyors and draftsmen Core drilling, assaying geological and prospecting support services Business and financial services and consultants Book keeping services Management services and consultants Advertising and marketing services and consultants Photocopying and duplicating services Typing and secretarial services Language translation and interpreting services Business security and protective services Debt collection and credit rating services Credit Schemes Other business and administrative services and agencies |

|

G1 |

Human and animal health services |

Medical practitioners Dental practitioners Optometrists Chiropractors Osteopaths Nursing services Masseurs and physiotherapists Midwives Veterinary services |

|

G2 |

Personal, social and recreational and repair services |

|

|

G2(a) |

Recreational Services |

Night Club & dance hall operator Show & entertainment operator Events Coordinator Cinema and theater operator Video operator Compact disc or digital video disk operator Owners or operators of electric and similar games Recreational and pleasure grounds and facilities Recreational sporting and social services |

|

G2(b) |

Barber and Beauty Services |

Beauty salons and centers Spa operator Barbers and hairdressing services Make-up Artist operator |

|

G2(c) |

Educational Services |

Riding School Diving School Day Care Center Kinder Garden School Account teachers and language tuition Schools and institutions conducted for profit Subscription libraries Museum operator |

|

G2(d) |

Repairs & Other Services |

Typists working alone Photographers Photo processing and photographers Domestic employment agencies Shopping services Laundries, Laundromats & dry cleaning Lawn mowing Landscaping and nature services Hire of CD or DVD equipment Hire of VCR and TV equipment Hire of Compact disk (CD) or digital video disk (DVD) Hire of Video cassette, Video cassette recorders and television equipment Vending machine owners Upholsterers Repairs of electrical machines and electronic equipment Other repair services |

|

I1 |

Electricity |

Electricity generation Electricity distribution |

|

I2 |

Telecommunications, telegraphic and communication service companies and providers |

National and/or international telephone service providers Internet Service Providers Data and transaction processing Electronic mail, voice mail facsimile services, including store and forward, store and retrieve |

|

I3 |

Water works |

Water works, distribution and supply companies and providers |

|

I4 |

Radio and television broadcasting companies and providers |

Radio broadcasting Television production, broadcasting and providers Television providers |

|

J |

Artist and Sculptors |

Artists Sculptors Other related activities |

|

K |

Planters, Farmers, Dairymen, Vegetable and Fruit Hawkers, and other Gardeners |

Planters Cattle Farmers Poultry Farmers Piggery Farmers Dairymen Stock Breeders Vegetables & Fruit Hawkers Market and other Gardeners Other related Farming Activities |

|

L |

Fishermen |

Fishing |

|

Ca |

How much does it cost for each of the business licenses?

Business License fees are charged according to the type of business activity carried out and the category it may fall under.

The fees vary depending on the turnover of each business activities under each category.

Under the Business License Act, Business Licenses are valid for one year and are subject to renewal on or before 31 January of the New licensing Year. This also applies to new applications being submitted during the year.

Annual Fees:

|

Category |

Fee (in Vatu) |

|

A, B, C, D, E, G, I |

· 10,000 for gross turnover of less than 4 million · 20,000 for gross turnover of 4 million to less than 10 million; 50,000 for gross turnover of 10 million to less than 20 million; 100,000 for gross turnover of 20 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 100 million; 500,000 for gross turnover of 100 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more. |

|

D5 |

· 5,000 for gross turnover of less than 4 million · 20,000 for gross turnover of 4 million to less than 10 million; 50,000 for gross turnover of 10 million to less than 20 million; 100,000 for gross turnover of 20 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 100 million; 500,000 for gross turnover of 100 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more. |

|

F1 |

· 7.00% of turnover for the licensing year subject to a minimum fee of 5,500,000 |

|

F2 |

· 5.00% on quarterly turnover where income is zero rated and exempted for VAT purposes, subject to a minimum fee of 330,000. · 10,000 for gross turnover of less than 4 million · 20,000 for gross turnover of 4 million to less than 10 million; 50,000 for gross turnover of 10 million to less than 20 million; 100,000 for gross turnover of 20 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 100 million; 500,000 for gross turnover of 100 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more. |

|

F3 |

· 20,000 for gross turnover of 4 million to less than 10 million; 50,000 for gross turnover of 10 million to less than 20 million; 100,000 for gross turnover of 20 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 100 million; 500,000 for gross turnover of 100 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more. |

|

F4 |

· 10,000 for gross turnover of less than 4 million · 20,000 for gross turnover of 4 million to less than 10 million; 50,000 for gross turnover of 10 million to less than 20 million; 100,000 for gross turnover of 20 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 100 million; 500,000 for gross turnover of 100 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more · 5.00% on quarterly turnover where income is zero rated and exempted for VAT purposes |

|

J, K, L |

· 50,000 for gross turnover of 10 million to less than 50 million; 250,000 for gross turnover of 50 million to less than 200 million; 1,000,000 for gross turnover of 200 million or more. |

Example of the Calculation of Business License Fees for New Businesses.

As mentioned, the fees are charged according to the annual business turnover shown in the business license schedule.

For every new business, the fee would fall under the first class of < VT10m turnover for that business category.

For example, if you were to apply for a business license to open a retail shop in January then the business activity would fall under the category D2, whereby the annual fee for turnover less than VT 10m is VT 20,000/yr.

For any business commencing later during the year, the business license fee will be charged on a pro-rata basis. For example, if the retail shop business commences in June:

Business License Fee = Category fee x no. of months/12

= D2 x 6/12

= 20,000 x 6/12

= VT 10, 000.

Where to go to obtain a Business License?

The Rates and Taxes Office under the Department of Customs and Inland Revenue (DCIR) is responsible for issuing business licenses in the municipalities of Port Vila and Luganville. The Physical location of this office is adjacent to the downtown police station, Port Vila Telephone: +678 24 969

Provincial Councils are responsible for issuing business licenses to businesses operating in areas outside of these two municipalities. Within each province, business owners must obtain their business licenses directly from the Provincial Council head office.

What is the penalty for operating without a Business License?

Any person (other than a person exempted under Schedule 2) who carries on a business without a license shall be guilty of an offence. Penalty is the payment of a fine not exceeding VT 500,000 or imprisonment not exceeding 1 year, or both. Any business that fails to renew its’ license on/ before the 31st of January will be penalized at a growing rate of 10% of every month that the fee was due until it is settled.

For more information on obtaining a business license, please visit: https://customsinlandrevenue.gov.vu

Business Certifications and Permits

Businesses operating in the musicality areas require business certifications or business permits.

Any business category operating inside the Port-Vila municipality requires a Permit Approval Certificate (or more commonly known simply as a Business Permit). In addition, certain businesses operating within the municipality of Port-Vila may also require additional permits (food businesses and liquor licenses).

Steps to obtaining Permit Approval Certificate

Step 1

Apply for Permit Approval Certificate: Visit the Port-Vila Municipality Licensing and Permit Department and advise the licensing officer you wish to apply for a Permit Approval Certificate (or Business Permit). The licensing officer will provide you with a standard letter and invoice.

Step 2

Pay fee: Take the letter and invoice to the cashier desk in the municipality office and pay the required fee. The cashier will issue you with a receipt attached to your letter. Bring the receipt and letter back to the licensing officer. All details about the business will be entered into their computer system, including your business activity and contact number.

Step 3

Collect Permit: The licensing officer will call when the Permit Approval Certificate is ready for collection from Municipality. It can take up to 2 weeks to process.

Forms required: VFSC business registration certificate and National ID.

Fees: The fees vary depending on business category and are accumulative (e.g.: If you are operating a retail & wholesale business you will need to pay the retail business permit and the wholesale business permit). The following fees are accurate as of 2021:

- Retail business: VT5,980

- Wholesale Business: VT11,960

- Food Business (e.g.: Café/restaurant/takeaway): VT 5,980

Payment methods: Cash, cheque and Eftpos for BSP and Bred Bank are accepted at the Municipality

Food Business

If you are operating a business that handles and sells food, there are additional steps required to obtain a Permit Approval Certificate (or Business Permit). You will need to conduct a Food Safety training course and obtain a Food Safety Certificate before receiving your Permit Approval Certificate. The Food Safety Certificate is a requirement for anyone who works in a setting where food is cooked, prepared or handled, such as a takeaway, café or restaurant.

Steps to obtaining Permit Approval Certificate/Business Permit for Food Business:

Step 1

Complete Food Safety and Handling Training: Visit the Finance department cashier desk and pay for the Food Safety and Handling training. The fee to pay is VT 3000 which you can pay in Cash, Cheque or BSP Eftpos. Upon payment, the cashier will issue you with a receipt. Take this receipt to the Environmental Health, Health Standards and Inspection (EHHSI) unit at the Ministry of Health. You will need to provide the receipt and your contact details (name and phone number). The EHHSI unit will call you to advise the location, date and time of the next training session. The training takes place over 3 consecutive days and you will receive a Food Safety certificate on the last day of training.

Step 2

Complete Health Inspection at Business Premises: Take Food Safety Certificate and VFSC Business Registration Certificate to the Municipality licensing department. The licensing officer will enter the details of your business into their system and will organise a date and time with you for a health inspection to be conducted at the business premises. Pay health inspection fee at the cashier desk at Municipality. The fee is VT 29,900 and can be paid in Cash, Cheque of BSP Eftpos.

Step 3

Pay for Business Permit: Once the inspection has been completed, visit the licensing department at Municipality and collect your approval letter and invoice for your business approval certificate (or business permit). Take approval letter and invoice to the Cashier desk. The fee is VT 5980 which can be paid in cash, cheque or BSP Eftpos. Upon payment, a receipt will be attached to the approval letter. Take approval letter and receipt to licensing department for processing.

Step 4: Collect business permit from the cashier desk after 5 to 10 business days.

Forms required: Food Safety Certificate, VFSC Business Registration Certificate (See Section 3), National ID

Fees:

- VT 3000 for Food Safety Training

- VT 29,900 for Health Inspection

- VT 5980 for Permit Approval Certificate/Business Permit

Payment Methods: Cash, Cheque or BSP Eftpos.

Office Location: The Finance Department is located on Rue Pasteur, Port-Vila and the EHHSI is located on Rue Cornwall, Port-Vila.

Liquor License

Step 1

Collect liquor license application form from the Department of Customs and Inland Revenue (DCIR) office, Taxpayer Services Section or from the DCIR’s website:

https://customsinlandrevenue.gov.vu/images/Forms/rates_taxes_forms/Liquor_Licence_Application.pdf

It consists of three application forms (all of which are of the same content) that need to be filled in and forwarded to the appropriate authorities for approval before it can be lodged at the Taxpayer Services Section for processing.

Step 2

Submit completed application form along with VFSC business registration certificate, police clearance and valid business license to licensing department at the Port-Vila Municipality for recommendation. If approved, the application will then be forwarded to the Police for verification. Verified forms are then sent to the Ministry of Internal Affairs for the Minister’s approval. Approved application form is then returned to town clerk at the Municipality.

Step 3

Collect completed liquor license application from municipality and take to the Customs and Inland Revenue office, Taxpayer Services Section and pay the appropriate liquor license fee.

This process usually takes at least a month to complete before the official liquor license is issued.

Required documents:

- Valid Police Clearance

- VFSC Business Registration Certificate (See Section 3)

- Valid Business License (See Section 4)

- National ID

Fees:

The liquor license fee is charged according to the different categories it falls under. The Liquor License Schedule Fees are as follows:

|

License Category |

Annual Fee |

|

A. Urban General off Licence |

VT 111,375 |

|

B. Rural General Off |

VT 55,688 |

|

C. Urban and Rural Limited off Licence |

VT 27,843 |

|

D. General on licence (except Bauerfield & Pekoa) |

VT 83,531 |

|

E. General on Licence – Bauerfield Airport |

VT 74,250 |

|

F. General on licence – Pekoa Airport |

VT 40,838 |

|

G. Limited on Licence |

VT 55,688 |

|

H. Combined General on and off Licence |

VT 157,781 |

|

I. Combined Limited on and off Licence |

VT 74,250 |

|

J. Cinema / Theatre License |

VT 46,406 |

|

K. Club Licence |

VT 55,688 |

|

L. Occasional License |

VT 4,640 |

|

M. Night Club License |

VT 83,531 |

|

N. Aerodrom Licence |

VT 22,275 |

|

O. Pleasure Boat Licence |

VT 22,275 |

|

P. Combined Urban General off & Limited on Licence |

VT 142,931 |

|

Q. Limited off Licence & General on License |

VT 92,813 |

|

R. General on License & a Night Club License |

VT 111,375 |

New licenses launched during the year will be charged on a pro-rata basis. For example, applicants applying for a new liquor license in the month of June shall pay only for the remaining seven months of the year. For example:

Liquor license annual fee = License category fee x no. of months/12

= VT 18, 563 x 7/12

= VT10, 828

Fees for new applications are to be paid within 30 days after approval from the Minister of Internal Affairs.

Validity/Penalties

Licenses are valid for one year and are subject to renewal on or before 31 January of the new licensing year.

This also applies to new liquor licenses lodged after 31 January.

Penalty fee of 10% for new licenses will be charged every month after 30 days have lapsed from the date of approval by the Minister of Internal Affairs.

The penalty fee period will be up to a maximum of 3 months.

Payments not made within that period will lead to cancellation of the liquor license.

Opening a Business Bank Account

Step 1. The first step in opening a business bank account is deciding what type of account suits your business need. Each account will offer different features and benefits and have different fees and requirements.

Some examples of the different types of commercial accounts you can open in Vanuatu and their features and benefits are as follows:

- Business Cheque Account: A business cheque account is a transactional account that offers you access to your funds by way of cheques, ATMs, EFTPOS and internet banking. You can make deposits by either visiting a branch, accessing Online Banking or by using the banks Fast Deposit Box (if available).

- Savings Account: A Savings Account is an all-in-one account, combining both transactional and savings features for daily banking needs with ATM, EFTPOS and internet banking access.

To help your decision on the best account type for your business needs and vision, it is recommended to visit and discuss this with the customer service section of the bank.

Step 2. Once you have decided on the type of account you want, you must apply to open a bank account. Each bank will have their own requirements for opening a new account. Discuss this with the customer service officer when you visit the bank.

How much does it cost to open an account and how much minimum deposit do you need?

Usually, opening a bank account has no cost. However, a minimum amount deposited into the account may be required. Each bank and each account will have different minimum amounts ranging from 5000 vatu to 250,000 vatu. Banks may sometimes offer promotions to those opening a new account and reduce or waive any minimum amounts. Therefore, it is best to contact each bank and find out their terms and conditions.

Aspects to consider to decide which bank you want to open an account with?

- Accessibility/Convenience

Consider the accessibility of the bank and its services. Are you operating a business in one of the islands? Does the bank have a branch/ATM available there? Do you need to purchase stock regularly from a certain shop in town, do they have facilities for your bank available? Do you regularly withdraw cash to pay for goods and is there an ATM near your business premises?

- Interest Rates

Rates and terms offered will vary from one bank to the next, so consider your financial goals and whether the conditions offered fit your needs.

- Services Offered

You may want a bank that offers debit card and credit card options, as well as lending products such as business loans. Ensure the bank you choose offers the services you will need to grow your business

- Understand the terms and conditions

You shouldn’t open a bank account without knowing what’s in the fine print. If there are monthly service fees, ask whether you can get them waived. If there are ATM charges, find out how much they are.

- Digital Features

Does the bank offer online banking and online digital platforms to make transactions easier?

What documents do you need to open a business bank account?

Each bank will have their own requirements, so it is best practice to contact your bank of choice and check with them. Most banks will however require you to complete and/or provide the following documents:

- Bank Account Application Form

- Valid Business License (See Section 7)

- Customer identification: The following are examples of required identification documents: valid passport, valid driving license, national ID card, birth certificate, health or pensioner card, tax assessment notice (less than three months old), Government benefits notice (less than three months old), Utility bill (less than three months old), Letter of Employment and Education Provider Letter.

What is the risk/disadvantage of not having a business bank account?

Not having a business bank account can be disadvantageous for several reasons:

- Gives an unprofessional appearance.

- Business name not on checks.

- Unable to conduct banking in the company name (example: if you wish to apply for a loan for the business)

- Difficult to prove separate transactions for VAT purposes.

- Mixing of funds.

Opening a Personal Bank Account

The steps to opening a personal bank account are quite similar to a business account. It is important you do your research and choose the right bank and account type for you and your personal financial goals.

Usually, to open a personal bank account, the bank will usually require the following documents:

- Account opening application form

- Proof of employment (employment letter for example)

- 3 latest pay slips

- 3 months of bank statement

- Proof of address (e.g.: utility bill)

Usually, a minimum deposit amount will be required when opening a personal account. This can range from VT 5000 to VT 20,000.